What makes Alberta’s oil and gas department so pivotal in Canada’s economy? Is Alberta’s oil and gas sector still the job powerhouse it used to be? And most importantly what opportunities and challenges await individuals looking to seek employment in this sector?

Alberta Economic Dashboard has data to show that Alberta produced about 4.3 million barrels per day of crude oil on average in 2023. Astoundingly, this is 84% of Canada’s total crude oil production that year.

According to a report by Statista, Alberta’s energy sector contributed approximately $119 billion to Canada’s annual GDP in 2023. Another Statista report shows that around 150,000 persons are currently employed in Alberta’s energy sector, with oil and gas accounting for a significant portion. So, things are looking sunny again after the recent downturns caused by fluctuating oil prices and changing environmental policies.

Statistics Canada showcases the fact that Alberta’s unemployment rate is 7.3% in Nov. 2024, which is just a little higher than Canada’s average unemployment rate of 6.9%. Canadian Energy Center has reported that over 26% of Canada’s energy workforce is university-qualified, reflecting the technical complexity of modern energy sector roles. Furthermore, Over 35% of workers in Alberta’s oil and gas sector are immigrants, according to Energy Now, highlighting the industry’s dependence on diverse talent pools.

This article explores the evolving landscape of Alberta’s oil and gas employment sector. During the process, it will also give some actionable insights to job seekers. Without further ado, let’s dive into the statistical insights and trends related to Alberta’s oil and gas sector.

Alberta’s Prominence in the Oil and Gas Sector: A 2024 Snapshot

A Statista research report shows that the province of Alberta has a huge 84.1% share in Canada’s oil production in 2024. The second-highest oil-producing Canadian province, Saskatchewan, has a 10.2% share. Newfoundland and Labrador come in third position with 4.5%.

| Provinces | Share of production |

| Alberta | 84.1% |

| Saskatchewan | 10.2% |

| Newfoundland and Labrador | 4.5% |

| Manitoba | 0.9% |

| British Columbia | 0.2% |

| Other | 0.1% |

In the Natural Gas sector, Alberta again dominates other Canadian provinces. According to the CER report, Alberta accounted for around 61% of the national production of marketable natural gas last year with British Columbia at second with about 37% share of production.

Alberta Employment Trends and Key Statistics 2024

Alberta’s supremacy in Canada’s oil and gas sector is due to robust levels of production, continuing investment, and technical diversification.

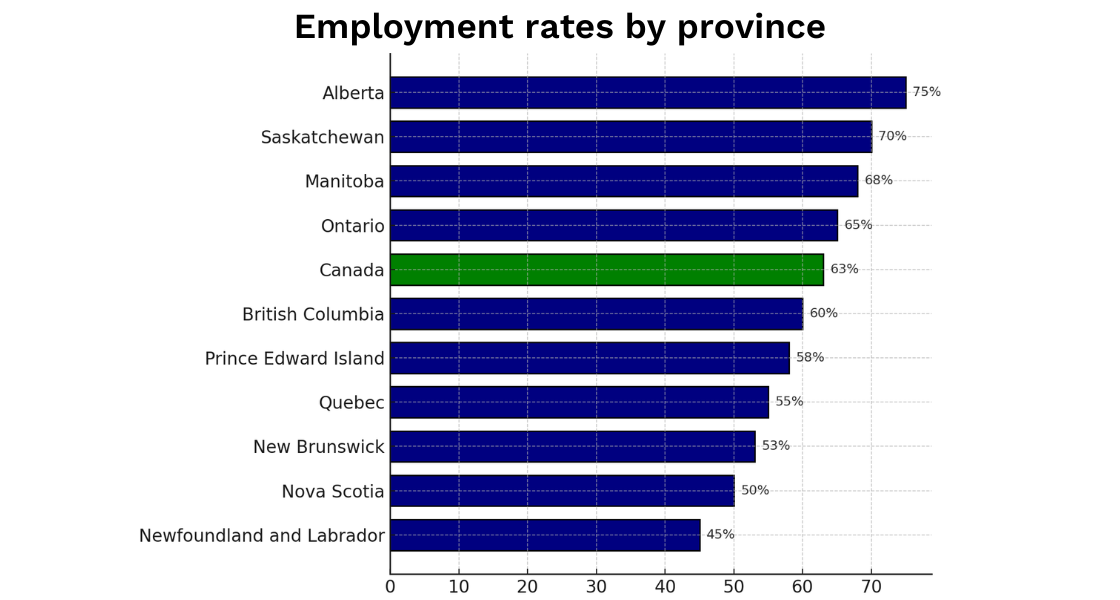

With all these credentials, it’s no wonder that Alberta’s oil and gas industry is a source of employment for tens of thousands of individuals, boosting the province’s employment rate to above 70%.

Some challenges and stability

Alberta’s energy sector is in a transformative state and understanding its key trends and statistics is vital for job seekers. While automation and green energy campaigns have affected job availability, core roles in extraction, engineering and operations are intact.

COVID era also caused decline in the province’s energy workforce, but this Statista report has shown signs of stabilization again. Some 150,000 people are employed across various roles in the energy sector.

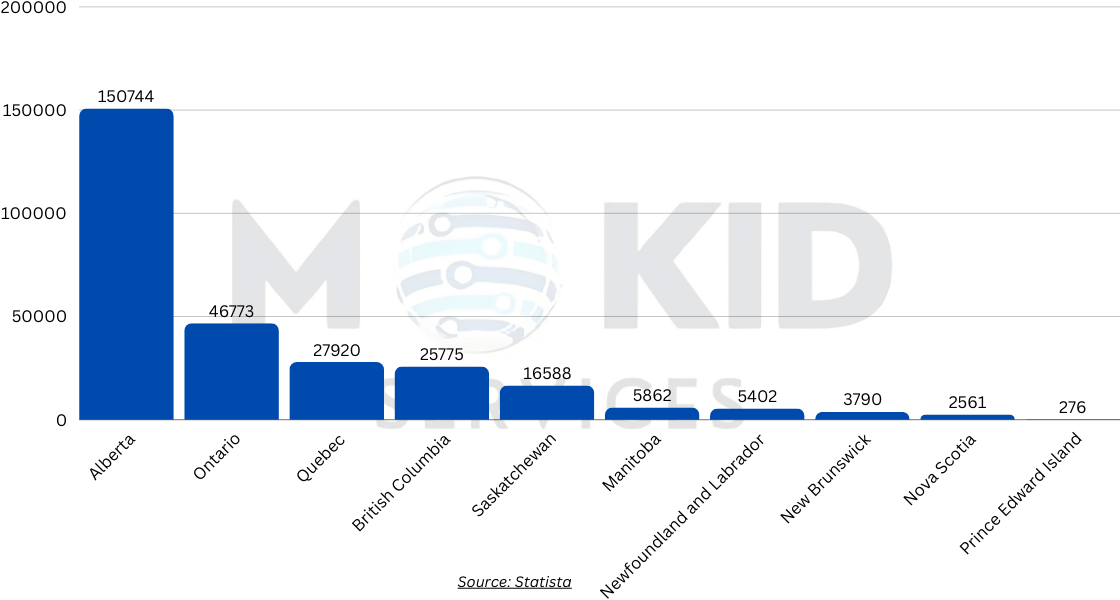

Number of Employees in the Energy Sector in Canada by Provinces in 2023

Job growth in core roles

According to Statistics Canada and Job Bank claims, about 25% of all jobs in Alberta’s energy sector are tied to oil and gas extraction. Key roles in this subdomain are process engineers, field operators and geo-scientists. Automation spree has not missed this field and there has been a rising demand for professionals skilled in automation and Artificial intelligence. More on this later.

Demographics of Alberta’s Oil and Gas Workforce

Canada’s workforce is increasingly diverse and the energy sector is no exception.

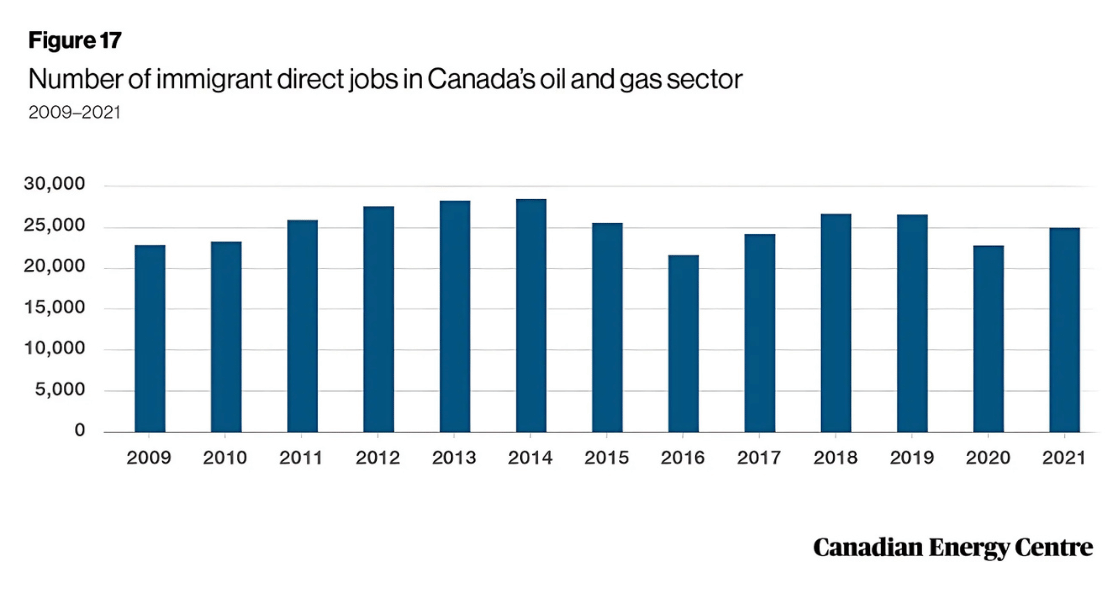

Immigrants:

Energy Now data shows that the immigrant employees percentage is about 35% in Alberta’s oil and gas sector. This is a 28% rise from 2009. Employment peaked at 58,896 in 2014, but declined to 48,099 in 2019 before recovering again to 51,180.

Average salary of immigrant employees in Canada’s oil and gas sector was $132,747 in 2019 according to Statistics Canada data (CEC).

Females:

Currently Women have above-30% share in Alberta’s oil and gas workforce. It was 42,846 in 2019 which was nearly 31% of the total 140,000 workforce then.

Average salary of women in Canada’s oil and gas sector was $110,975 in 2019 according to a survey by the Canadian Energy Center (CEC) . However it later declined to $106,875 in 2021.This is still a 27% increase from 2009.

Both educated and skillful:

A growing number of highly educated and university qualified people are embracing Alberta’s oil and gas sector. According to Statistics Canada’s report 33% of employees have university degrees, mostly in engineering, project management, geology or environmental sciences.

On the other hand, roles requiring handy skills and Trade certifications, such as drillers, welders and electricians, are also in demand. This is particularly true for regions like Fort McMurray and Grande Prairie.

Regional variations:

Most of Alberta’s oil and gas related field jobs are concentrated in Northern Alberta. The Athabasca oil sand region in northeast Alberta produces the bulk of Alberta’s crude oil. Field operators like welders, technicians and other support staff have maximum induction there.

While urban areas like Calgary, also known as the province’s energy capital, offer most of the administrative and corporate jobs in the energy sector.

Salaries and compensations:

Alberta’s oil and gas sector continues to offer competitive wages. For example the average annual salary of a petroleum engineer is more than $110,000 while technicians and field operators also earn upto $70,000 according to ZipRecruiter data. These figures mean Alberta is the most lucrative province for the energy workforce.

Technological Innovations in Alberta’s Oil and Gas Sector

AI and automation are reshaping Alberta’s energy employment. This trend has had a negative effect on the labour workforce. According to Statistics Canada nearly 20% of manual jobs have been automated in the oil and gas sector. While technology-driven fields like Data Analysis, Robotics and Programming have seen an increased demand.

Automation’s influence

Oil sand operations in Alberta, such as those in Fort McMurray, now use automated trucks and drones for site inspection, exploration and monitoring. Automation trend has caused a 15 to 20% drop in operational jobs. On the flip side this has created demand for automation experts, robotics technicians and computer programmers. According to Alberta Energy Regulator (AER) companies like Suncor Energy have invested as much as $1 billion in automation in Alberta’s oil and gas sector.

Need for upskilling and reskilling

To tackle these changes the need to upskill and reskill is paramount. Programs like NAIT’s (Northern Alberta Institute of Technology) Energy Technology Training Initiative have been really helpful in this regard. NAIT says that enrollment in AI and data analytics has grown by 25% in the last two years.

Rural Northern Alberta has been slower in adoption of advanced Technology compared to urban hubs like Calgary. So naturally cities have become hotspots for modern roles like engineers, data analysts and tech developers. While rural areas are still relying on traditional, manual roles like drillers.

Top Employers and Workforce Challenges 2024

Alberta’s oil and gas sector is home to some of Canada’s most efficient energy companies: Suncor Energy, Cenovus Energy, Imperial Oil and CNRL. These employers account for thousands of jobs in extraction, refining and corporate roles. Calgary-based Suncor and Cenovus are especially spearheading the automation and environmental compliance drives.

Alberta’s energy sector challenges

Challenges are there. According to PetroLMI (Petroleum Labour Market Information Division) 27% of companies are finding it difficult to recruit for advanced technical roles. These roles were created due to rapid industry wide automation.

Environmental policies such as carbon taxes and pipeline restrictions have further exacerbated the matters. Previous downturns caused by global price fluctuations have made the firms more wary. Many firms are now more focused on efficiency instead of expansion.

One more imminent problem is that the workforce in Alberta’s oil and gas sector is aging with over 22% fast nearing retirement. Young, tech savvy talent is required. Industry-Government joint initiatives like Canada-Alberta Job Grant are trying to address this issue by funding upskilling ventures. Meanwhile career counseling and coaching services are valuable to guide candidates to prepare for high-demand roles in an evolving industry.

Career Opportunities in Alberta’s Oil and Gas Sector

The evolving landscape of Alberta’s oil and gas sector is an opportunity for new talent. While automation dominates the trends, traditional roles are still intact.

High-demand Roles 2024

- Automation and Data Specialist: Companies like Suncor are adopting automation fast, needing qualified professionals like automation engineers and data analysts.

- Environmental Compliance Officers: In the wake of stricter environmental regulations, roles ensuring smooth and sustainable operations are essential in firms like Cenovus Energy.

- Skilled Traders: Field, skilled professionals like welders, electricians and heavy equipment operators have their own indispensable niches carved out.

Advice For job seekers

People looking to enter or advance their careers in Alberta’s energy sector should:-

- Focus on emerging roles: Target roles in sustainability, automation and analytics.

- Reskill and upskill: Participate in training programs funded by entities like Canada-Alberta Job Grant to upskill for industry-aligned roles.

- Tailor their resumes: To showcase relevant qualifications and highlight their acquired skills and certifications.

- Connect Employers: Attend events like the Global Petroleum Show in Calgary for earning insights and networking opportunities with potential employers.

Conclusion: Navigating Alberta’s Oil and Gas Employment in 2024

Alberta’s oil and gas industry in 2024 and ahead reflect resilience and steady transformation towards state of the art. While traditional manual roles are still intact, newer opportunities in automation, programming, sustainability and analytics are tugging and reshaping the energy sector.

It’s heartening to see the top employers and stakeholders like the government and corporate world investing in upskilling and training. However challenges like aging workforce, young talent recruitment, maintaining profitability, changing policies are still there to tackle. But these challenges are more opportunities than handicaps for job seekers.

To survive and thrive in this evolving landscape, new professionals and job seekers must adapt. Investing in certifications like H2S Alive or transitioning into high-demand, tech-focused roles can make all the difference.

And finally for people looking to reshape their careers or craft targeted resumes, tapping into a professional career guidance program tailored to Alberta’s energy employment is invaluable. With the right approach and mindset the industry continues to offer promising opportunities for growth and fulfillment.

Frequently Asked Questions

Q. What roles are most in demand in Alberta’s oil and gas sector in 2024?

Automation engineers, environmental compliance officers, programmers, robotics experts and data analysts are in high demand. Traditional field operators like welders, electricians and heavy equipment operators are also in demand.

Q. How can job seekers stand out in this competitive industry?

Pursuing certifications like H2S Alive and leveraging premium career counseling services to tailor resumes can hold one in good stead to enter Alberta’s competitive energy sector.

Q. Which certifications are essential for oil and gas jobs in Alberta?

Certifications like H2S Alive, WHMIS and First Aid are must-have for operation roles.

Q. What challenges do the oil and gas industry face in Alberta?

The oil and gas sector in Alberta struggles with workforce aging, policy changes like hikes in carbon taxes and market fluctuations that affect job stability.

Q. How to improve your chances of landing a role in the oil and gas sector in Alberta?

Tailoring resumes to highlight relevant skills and certifications, attending industry events like Calgary’s Global Energy Show and seeking career counseling can significantly increase the odds in favour of job seekers.

Q. How much do oil and gas jobs pay in Alberta?

According to Alberta ALIS, oil and gas jobs pay very handsomely in Alberta. For well drilling and field operating staff it’s $33.54 per hour on average, amounting to $65,187 per year. ZipRecruiter claims that top earning field technicians are looking at a $100,000 annual salary.

Q. What is Labor wages in the oil and gas industry in Alberta?

ZipRecruiter data shows that hourly wage for ordinary field workers and support staff in the oil and gas industry, Alberta is $23/hour on average, which is a little higher than the national average of $20/hour.

Q. How to get into the oil and gas industry in Alberta?

There are different career paths. You can get a degree in a relevant field like petroleum engineering to enhance your prospects. However For entry-level positions only a high school diploma and on-the-job training are enough. Coupling it with industry-approved certification or training courses can promote your cause. Networking within the industry and pursuing internships is also a good course for action.